Whenever you're taking payment from one of your awesome customers by credit card, and the card isn’t present in that transaction, there's going to be some risk. From fraudulent transactions, and chargebacks, to data breaches and identity theft, businesses face various risks when processing card-not-present transactions.

So what can you do? Well, one way to completely safeguard against zed risk, is asking your customer to sign a credit card authorization form. This is essentially a document that lets you charge their credit card on an ongoing basis.

In this complete guide, we're giving you the complete lowdown on these types of forms. We’ll answer those gnawing questions like:

Let's get started.

A credit card authorization form is a document, signed by the cardholder (aka your customer), that lets merchants charge their credit card for recurring payments during a certain amount of time that's noted in the document. The form is used to give companies the authority to charge the cardholder on a recurring basis (we're talking monthly, quarterly, or more annually).

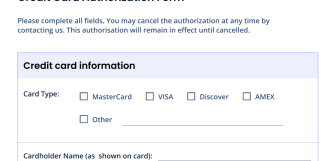

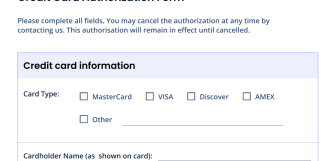

You definitely don't need to overcomplicate a credit card authorization form. It normally includes:

Now, there's more than one type of credit card authorization form that you can use to suit your customer's different payment needs. These are:

This form allows a single charge to your customer's credit card. It's used for one-off payments. For example, say you own an electronic store and a customer is buying an expensive item like a flat-screen TV. They might use a one-time credit card authorization to complete the purchase securely.

This form lets you charge your customer's credit card regularly. It’s really handy for subscriptions and monthly bills. Say you own a gym, for example, you could use a recurring credit card authorization form to bill members monthly for their gym memberships.

Now, an ACH bank payment lets you make a one-time payment directly from your bank account. It’s normally used for larger transactions. For instance, a customer booking a large event space at a hotel might use an ACH bank payment authorization to pay for the venue rental in one lump sum.

Finally, we've got our recurring ACH bank payments. This is where you can set up regular payments from your customer's bank account. It’s great for automated bill payments and consistent expenses. A boutique hotel might use recurring ACH bank payments to charge guests staying long-term on a weekly basis.

Take integrated payments at one fixed rate, with no hidden fees - anywhere, any time.

Accepting a payment with a credit card form is pretty straightforward. First, make sure your customer fills out all the necessary details on the form, like their name, card number, expiration date, and CVV (that’s your Card Verification Value).

Once everything's filled in, you can either process the payment manually if you're using a physical form or enter the information into your payment system if it's digital.

If you're using a card machine or POS system , simply swipe or insert the customer's card and follow the prompts on the screen to complete the transaction. If you're billing them later, you can store their card info securely using a feature like Card on File, so you can charge them with just a few clicks next time.

TIP: Check out our complete guide on how to accept credit card payments for more info on accepting payments.

At Epos Now, we like to go the extra mile to help out our customers. That's why we've created a free, simple-to-use credit card authorization form for you to download. You don't have to use our payment processing services for these templates either. Just download them as-is and add some features like your business logo or any specific language you want to include:

Yes, they do! Chargebacks are meant to protect consumers from unauthorized transactions. However, they can cause major headaches for businesses. When a customer disputes a charge, the funds are held until the card issuer decides what to do. This process is time-consuming and involves a lot of paperwork.

A credit card authorization form can help avoid this issue. If you have a signed document from the cardholder, it shows you had their permission to charge their card. This makes it much easier to win your case with the card issuer. It’s a simple step that can save you a lot of trouble.

How long does a credit card authorization last?Credit card authorizations can be valid for as long as you need them, but there are some key things to keep in mind:

Firstly, keeping signed authorization forms for two to three months after you stop charging the card. This helps in case there are any disputes or chargebacks.

When storing the forms, store physical ones in a locked room or filing cabinet. Only let employees who need them for their job access these forms. For digital forms, be sure to use a secure, encrypted client portal or a secure file transfer app.

Following these steps helps you stay PCI compliant.

Is a credit card authorization form safe?A credit card authorization form can be safe, you just need to make sure you handle and store them properly. To do this, be sure to follow security protocols, like PCI compliance standards, which require businesses to restrict physical access to cardholder data and ensure secure storage of completed forms. Using secure methods like encrypted digital storage or locked physical storage can help protect sensitive data.

What is Card on File?Card on File is a handy feature that lets you securely store your customers' payment information with Epos Now, once you've got their permission. This makes it super easy to charge returning customers, whether they're buying online, in person through your POS system, or via an invoice. If you often bill customers remotely by entering their card info into your card machine , Card on File lets you charge them later without needing to re-enter their details every time.

Am I legally obligated to use credit card authorization forms?Not at all. However credit card authorization forms are definitely a best practice for merchants like yourself. Be sure to speak to your lawyer about them and when they'd suggest you use one.